American Express Gold Card India Review

American Express Gold card India is another Amex India card and if you use it smartly it can give you around 10% return in the first year itself with its updated 18K and 24K Gold collection redemption options. But please note that it’s a charge card and not a credit card.

Table of Contents

Difference between Amex Gold Card and other Cards

Amex India Gold Card is a charge card. This card comes with no preset limit however you need to pay the whole amount before the bill due date otherwise it reflects as a Miss in your credit score.

The concept of EMIs and minimum balance payment that we have in other American Express or other Visa/Mastercard credit cards from other banks is not applicable in case of Charge Cards.

Overview of the card

- Joining Fee – Rs 1000 + GST

- Renewal Fee – Rs 4500+GST

- Regular Reward Rate* – 1 point per Rs 50 spent (includes fuel & utility bills but not insurance)

- Normal Value of 1 MR point – Rs 0.25

- Welcome Benefit – 4000 MR points

- Renewal benefit – 5000 MR points on renewal fee payment

*Amex pays rewards on wallet upload (one of the few cards that still pays rewards on wallet loads)

Bonus Reward Structure:

- 6 transactions of Rs 1000 in a calendar month will give bonus 1000 MR rewards points.

- 5X rewards as part of Amex multiplier program

Reward Redemption – Normal and Gold Collection

Normal redemption value of 1 MR point is Rs 0.25 and this can be simply redeemed across multiple options on Amex website and also for air miles but the great part about this card that I like is the 18 Karat and 24 Karat gold collection redemption options given by Amex.

Through this collection, you can increase the value of redemption of your MR points from Rs 0.25 to even Rs 0.58. This is applicable for both Amex Gold as well as Amex Membership rewards Credit Card (Amex MRCC)

How to Maximize Returns on Amex Gold card

1. Amex Monthly Transactions

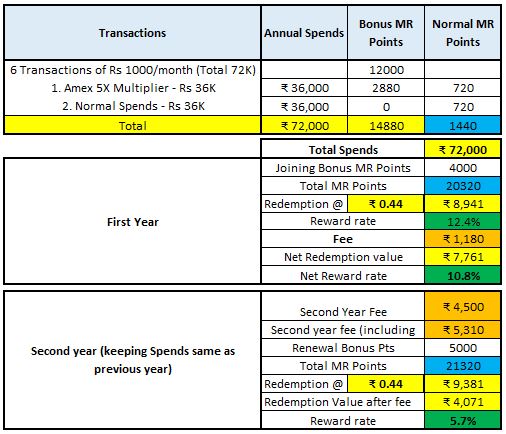

- Every month you can do 6 transactions of Rs 1000 (total 6000 spent per month X 12 months) – Total 12000 points on Rs 72000 spends

This will mean total 12000 points on Rs 72000 spends.

2. Amex Multiplier

Another way you can increase reward rate is through Amex Multiplier program. This is similar to loyalty programs where you go to a brand website through the Amex website & use Amex Card and get more reward points. Amex Gold card has 5X multiplier, so instead of 2 MR points per 100 spent, you get 10 points. I am assuming half of your 72K spends will be through Amex multiplier.

3. Redemption on 18K and 24K Gold Collection

Normal redemption value is Rs 0.25/point. You are smart and now you will use 18K or 24K gold collection to redeem points and for calculation, I am taking the average value of redemption for Rs 0.44

Calculation table

Since it is difficult to get the POS machines or merchants accepting Amex cards, so simple tricks that I employ to achieve bonus spends of 6*1000 per month

- I use Amex card to load Mobikwik / Amazon Pay wallets since Amex is one of the few cards still giving reward points on Wallet spends

- I use Amex cards to buy e-vouchers from the Amex multiplier portal and get 5X rewards as well

The reward rate is pretty good in the first year and very high. But second year onwards, the reward rate starts going down significantly due to increased fee.

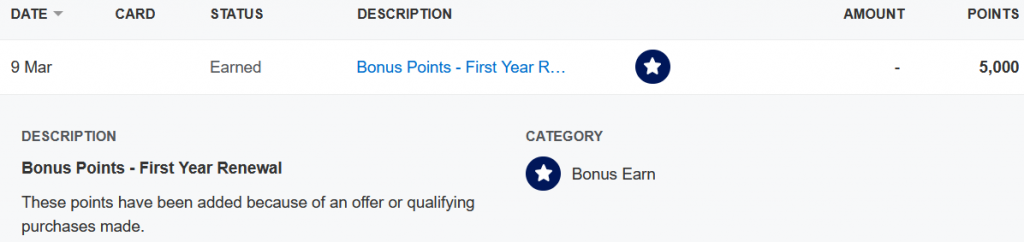

Renewal Update

My Amex Gold came up for renewal and they offered me 10000 MR points as retention benefit. This made the reward rate around 9% which led me to keep the card.

The fun part was that I also got the 5000 MR points (card feature) renewal bonus for the second year on top the 10K received already. This was a bit of positive surprise for me.

My take on this

This card is similar to Amex Membership Rewards Credit Card (Amex MRCC) with the same 18K and 24K Gold collection redemption options and as I mentioned above it’s a charge card and rewards on fuel & utility. The major drawback remains the high second year fee and which can’t be waived off basis spends (as in case of Amex MRCC on 1.5 Lacs spends).

I suggest to take this card for the first year, do some nice 10% reward earning and then negotiate for the reduced fee 2nd year onwards. If the fee reduction happens or you get a good offer, then great, otherwise cancel this card and move your spends to some other banks card and continue with some other Amex card.

If you liked this post, then please do share.

If you want to apply to this Card (or any other Amex card) for the benefits, please use my referral link to apply Amex India Gold Card by clicking here:

https://americanexpress.com/en-in/referral/tARUNBxmEu?CPID=999999544

You will get additional 2000 MR bonus points if apply Amex Gold Card through referral

Keep reading and please keep sharing…. More Bachat on the way!!!!

whoah this blog is magnificent i love reading your articles. Keep up the great work! You know, a lot of people are hunting around for this info, you can aid them greatly.

Thanks for your kind words