American Express Membership Rewards Credit Card Review

American Express Membership Rewards Credit Card (Amex MRCC) is a highly rewarding credit card from Amex India. Amex is known for its customer service and premium features and markets this as an entry level card. But if you use this card smartly, then you can achieve rewards of >5% with its updated 18K and 24K Gold collection redemption options, which is even better than some premium cards.

Table of Contents

Overview of the card

- Joining Fee – Rs 1000 + GST

- Renewal Fee – Rs 4500+GST

- 50% Fee waiver on spends of Rs 90K

- 100% Fee waiver on spends of Rs 1.5 Lac

- Regular Reward Rate* – 1 point per Rs 50 spent (excludes fuel, insurance & utility bills)

- Normal Value of 1 MR point – Rs 0.25

- Welcome Benefit – 4000 MR points

*Amex pays rewards on wallet upload (one of the few cards that still pays rewards on wallet loads)

The good part is that if you apply Amex MRCC through my referral, you will get the below benefits

– Joining Fee = Rs 1000 0 (First Year Free)

– Renewal Fee – Rs 4500 1500 + GST (Big reduction in fee)

https://americanexpress.com/en-in/referral/tARUNBhFyx?CPID=999999544

If you want to know more about the benefits for you to apply through Amex India referral program, then click here.

Bonus Reward Structure:

- 4 transactions of Rs 1500 in a calendar month will give bonus 1000 MR rewards points.

- Spends exceeding Rs 20000 in a calendar month will give bonus 1000 MR reward points. (You will need to register for this offer from Amex account – https://amex.co/mrccenroll )

- 2X rewards as part of Amex multiplier program

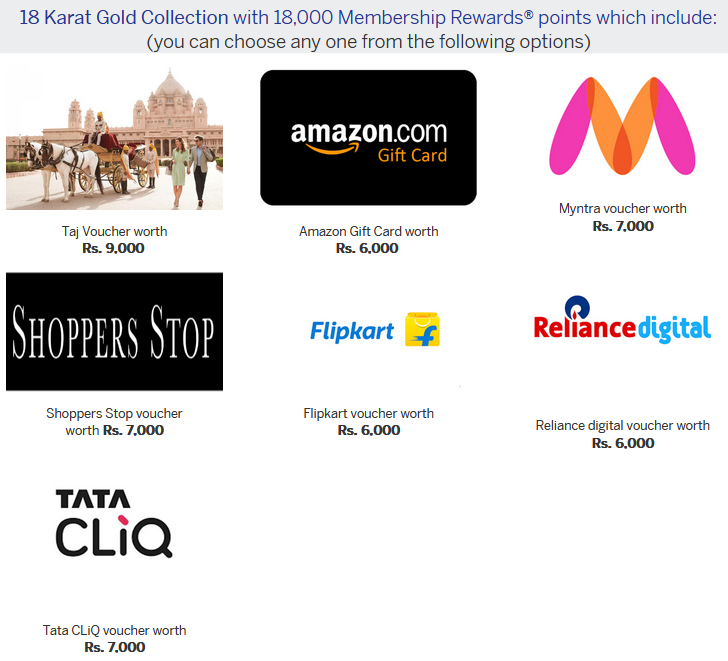

Reward Redemption – Normal and Gold Collection

Normal redemption value of 1 MR point is Rs 0.25 and this can be simply redeemed across multiple options on Amex website and also for air miles but the great part about this card that I like is the 18 Karat and 24 Karat gold collection redemption options given by Amex.

Through this collection, you can increase the value of redemption of your MR points from Rs 0.25 to even Rs 0.58.

They had updated their redemption options under the Gold collection rewards and I have written a post about this here.

Redemption value of 1 MR point on e-voucher under 18K Amex Gold Collection

- Taj – Rs 9000 (Rs 0.5/ MR point)

- Shoppers Stop Rs 7000 (Rs 0.39/MR point)

- Myntra – Rs 7000 (Rs 0.39/MR point)

- Tata Cliq – Rs 7000 (Rs 0.39/MR point)

- Amazon – Rs 6000 (Rs 0.33/MR point)

- Flipkart – Rs 6000 (Rs 0.39/MR point)

- Reliance Digital – Rs 6000 (Rs 0.33/MR point)

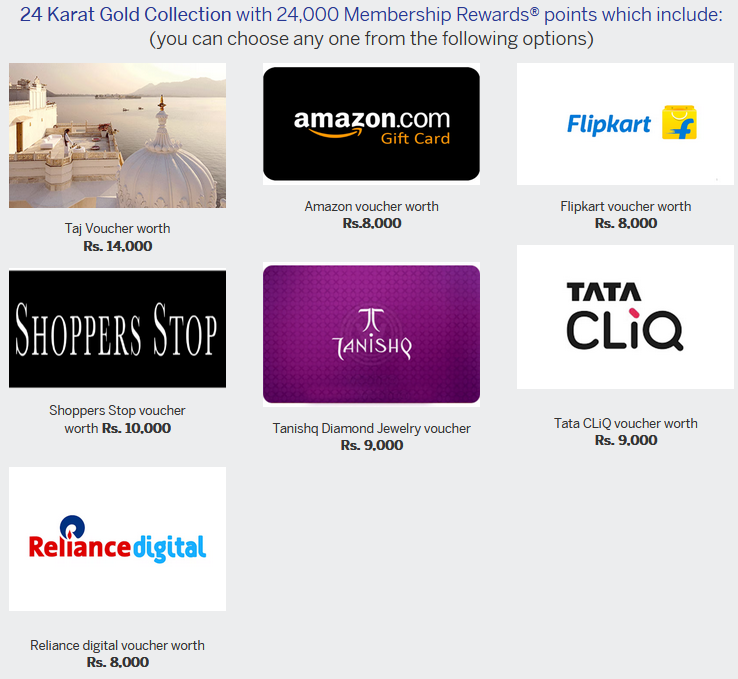

Redemption value of 1 MR point on e-voucher under 24K Amex Gold Collection

- Taj – Rs 14000 (Rs 0.58/ MR point)

- Shoppers Stop – Rs 10000 (Rs 0.42/MR point)

- Tanishq – Rs 9000 (Rs 0.38/MR point)

- Tata Cliq – Rs 9000 (Rs 0.38/MR point)

- Amazon – Rs 8000 (Rs 0.33/MR point)

- Flipkart – Rs 8000 (Rs 0.33/MR point)

- Reliance Digital – Rs 8000 (Rs 0.33/MR point)

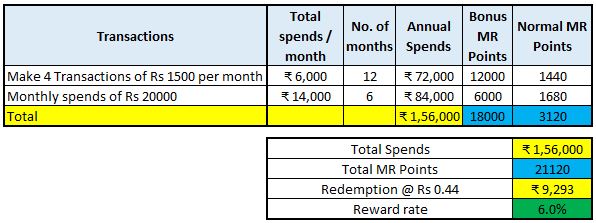

How to Maximize Returns on Amex MRCC card

- Every month you can do 4 transactions of Rs 1500 (total 6000 spent per month X 12 months) – Total 12000 points on Rs 72000 spends

- For 6 months, you do additional 14000 spends to achieve 20,000 spends to receive another 1000 points per month (Total 6000 points on 84000 spends)

This will mean total 18000 points on Rs 1.56 Lac spends. This 1.5 Lac spend waives your annual credit card fee.

You are smart and now you will use 18K or 24K gold collection to redeem points and for calculation, I am taking an average voucher redemption for Rs 0.44

This will mean that you will get annual fee waiver and additionally get 18000 points equal to Rs 9000 on spends of 1.56 Lac which is equal to whopping 6% redemption rate.

Calculations

Trick to achieve bonus spends

The high reward rate is good part however it is difficult to get the POS machines or merchants accepting Amex cards, so 2 simple tricks that I employ to achieve bonus spends of 4*1500 per month

- I use Amex card to load Mobikwik / Amazon Pay wallets since Amex is one of the few cards still giving reward points on Wallet spends

- I use Amex cards to buy e-vouchers from the Amex portal.

My take on this

I have been using this card since last 2 years and I love this card since there is hardly any credit card that will give you this high reward rate of 6%. You may increase the reward rate depending upon which vouchers you take and some months you may have more or less spendings but if this card is used correctly and MR points are accumulated and redeemed on the 18K/24K gold collection, then you can definitely get reward rate in excess of 5% and can go to approx. 8% (Taj voucher redemption at Rs 0.58/point).

There are additional promotional offers and discounts from American express round the year which give discounts and additional reward points or vouchers etc helping get more benefits for bachat.

I would highly rate this card and should be part of your collection.

If you are worried on the fee for Amex MRCC and If you want to apply to this card (or any other Amex card) for the benefits, please use my Amex MRCC referral link to join by clicking here:

https://americanexpress.com/en-in/referral/tARUNBhFyx?CPID=999999544

If apply Amex MRCC through referral link, you will get first year free (FYF) along with 2000 MR bonus point and reduced fee of Rs 1500 2nd year onwards

If you want to know more about the benefits for you to apply through Amex India referral program, then click here.

Keep reading and please keep sharing…. More Bachat on the way!!!!