IDFC First Bank Credit Cards Review

IDFC First Bank Credit Cards were launched last year by the IDFC First Bank under 4 variants – Millennia, Classic, Select and Wealth and in this post, I will discuss the differences in benefits between these variants and also discuss how to maximize the benefits and increase your Bachat through these cards.

Table of Contents

Key Features of IDFC First Banks Credit Cards

- First important benefit is that all the variant Cards have no annual fee and are Lifetime free

- Interest rate is dynamic and depends upon the user credit score and relationship with the bank and starts from 9%-42%. My Card has 34%. (However, I would say that if if you want to save money, pay all the credit card bill on time and it wont matter how high or low interest rate is)

- They have innovative 3x (offline spends), 6x (Online spends) and 10x on birthday or after crossing threshold monthly spends. This threshold varies across each variant.

- 1 reward point equals Rs 0.25 (and mentioned as 1X) and these reward points can redeemed to pay for online or offline purchases.

- Reward points never expire, so you can continue to accumulate for a big purchase.

- Joining Benefit – All variants have Rs 500 Amazon Voucher on spends of Rs 15000

- Complimentary Roadside Assistance worth ₹1,399 (You need to call Global Assure 24×7 Toll-free Number 1800 572 3860)

IDFC First Credit Card Variants

IDFC First Millennia

- 3x (offline) and 6x (online) based on Reward calculation – 1x (1 reward point per Rs 150 spent).

- 10x on threshold above Rs 20000.

- Reward rate comes out to be 0.5% for offline spends, 1% for online spends and 1.67% after Rs 20000 threshold.

- 25% discount upto Rs 100 on Movie tickets booked through Paytm App (one per month)

- 4 Complimentary Railway Lounge Visits per quarter

It’s a base level card and could be a good beginning if you are having existing relationship with IDFC bank.

IDFC First Classic

- 3x (offline) and 6x (online) based on Reward calculation – 1x (1 reward point per Rs 150 spent).

- 10x on threshold above Rs 20000.

- Reward rate comes out to be 0.5% for offline spends, 1% for online spends and 1.67% after Rs 20000 threshold.

- 25% discount upto Rs 100 on Movie tickets booked through Paytm App (one per month)

- 4 Complimentary Railway Lounge Visits per quarter

If you note, the features and reward rate earning are same as First Millennia. Maybe the interest rate offered will be different or they may plan to differentiate later. So, I will say if you are eligible for Classic then go for Classic.

IDFC First Select

- 3x (offline) and 6x (online) based on Reward calculation – 1x (1 reward point per Rs 125 spent).

- 10x on threshold above Rs 25000.

- Reward rate comes out to be 0.6% for offline spends, 1.2% for online spends and 1.67% after Rs 25000 threshold.

- BOGO (Buy one Get one) offer upto Rs 250 on Movie tickets booked through Paytm App (twice per month)

- 4 Complimentary Railway Lounge Visits per quarter

- 4 Complimentary Domestic Airport lounge visits per quarter

IDFC First Wealth

- 3x (offline) and 6x (online) based on Reward calculation – 1x (1 reward point per Rs 100 spent).

- 10x on threshold above Rs 30000.

- Reward rate comes out to be 0.75% for offline spends, 1.5% for online spends and 2.50% after Rs 30000 threshold.

- BOGO (Buy one Get one) offer upto Rs 500 on Movie tickets booked through Paytm App (twice per month)

- 4 Complimentary Railway Lounge Visits per quarter

- 4 Complimentary Domestic Airport lounge, International Airport lounge and Spa visits per quarter. (You will get Dreamfolks Dragon Pass)

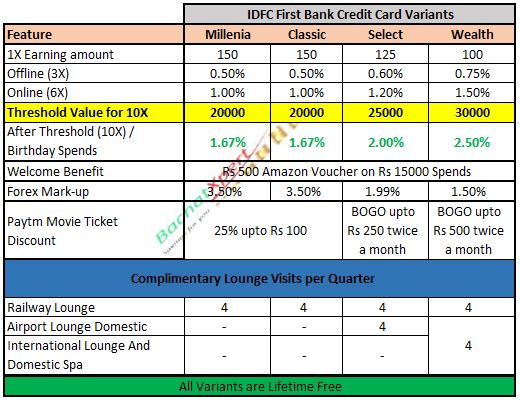

Summary for the IDFC First Bank Credit Card Variants

The above would be too much information for some users, so I have prepared a tabular comparison picture to differentiate between the variants.

Fine Print to Note

While using any financial product, we must read the fine print and I would like to highlight the below fineprint points which marketing folks won’t tell.

- The 10X points only start after crossing threshold and are applicable on incremental spends. As an example, if 10X threshold is Rs 25000, then the spends till Rs 25K are for 3x and 6x rewards and for amount above Rs 25K, the 10X rewards will be applicable.

- Redemption fee from 1st October 2022 is Rs 99+GST

- Rental and Property management transactions earn 3X points only and are not part of 10X reward program and 10X threshold calculations. Additional 1% surcharge applicable on rental transactions.

- Reward program not applicable on Fuel, Insurance, EMI transactions & Cash withdrawals. So Fuel surcharge benefit of 1% makes little sense to use these cards for fuel since no reward accrual, so instead go for fuel specific card.

- IDFC advertises interest free cash withdrawal but please note that there is a fee of Rs 250 + GST on this totalling Rs 295 fee on cash withdrawal so please donot withdraw cash from IDFC or any other brand’s credit card. This should only be used for emergency use.

My Take on this

The IDFC First Bank Select card has been in possession for last 10 months. As mentioned above, the card gives 0.6% reward points and 1.2% reward points for online spends. I have other cards which give higher rewards per transaction and I use them for day to day transactions but the beauty of this card is the 10X rewards system.

And If you have a large payment once in a while, this card would give you quite good rewards in those months and since it’s a Lifetime free, there are no spend milestones to achieve or worry about. Whichever month, I need to make a large single payment like a fee etc., I use this card for the payment and maximise my savings through the 10X rewards system.

Second, the card has been used for airport lounge and the Paytm movie BOGO offer and some websites where I got 10-15% off like Bigbasket etc.

Besides this, the other variants are also quite good with the 10X rewards considering they are lifetime free. The Wealth card has the Dreamfolks Card for airport and spa usage which is not usually available in other cards. Also, the roadside assistance option seems great but hopefully no one needs to use the same.

I just wish the threshold is reduced for the cards to increase the savings.

If you wish to apply for IDFC First card, please click below:

https://ekaro.in/enkr20220807s14016584

Keep reading and please keep sharing… More Bachat on the way!!!