SBI Cashback Credit Card Review

SBI has launched SBI Cashback credit card on 1st Sept and it looks like an unbelievably great card with 5% cashback feature embedded into the card for ALL online spends. The card seems too good to be true and maybe they may downgrade this later but I think as the old saying goes – ‘Make hay while the sun shines’, so do seriously consider getting this card.

Overview of SBI Cashback Card

- Joining Fee – Nil

- Annual Fee – 999 + GST (Renewal Fee reversed if spends greater than Rs 2 Lac)

- Currently the card is being offered free (till March 2023) for first year with no welcome benefits.

Reward Rates

- 5% cashback^ on all* online spends

- 1% cashback on all* offline spends and utility bill payments

^ 5% cashback is capped at Rs 10,000 per statement month (Basically till Rs 2 Lacs monthly online spends, you get 5% cashback and incremental spends will have 1% cashback)

*Cashback not applicable on rent payments, wallet loads, Merchant EMIs, cash advances, Balance transfer, Encash and Flexipay

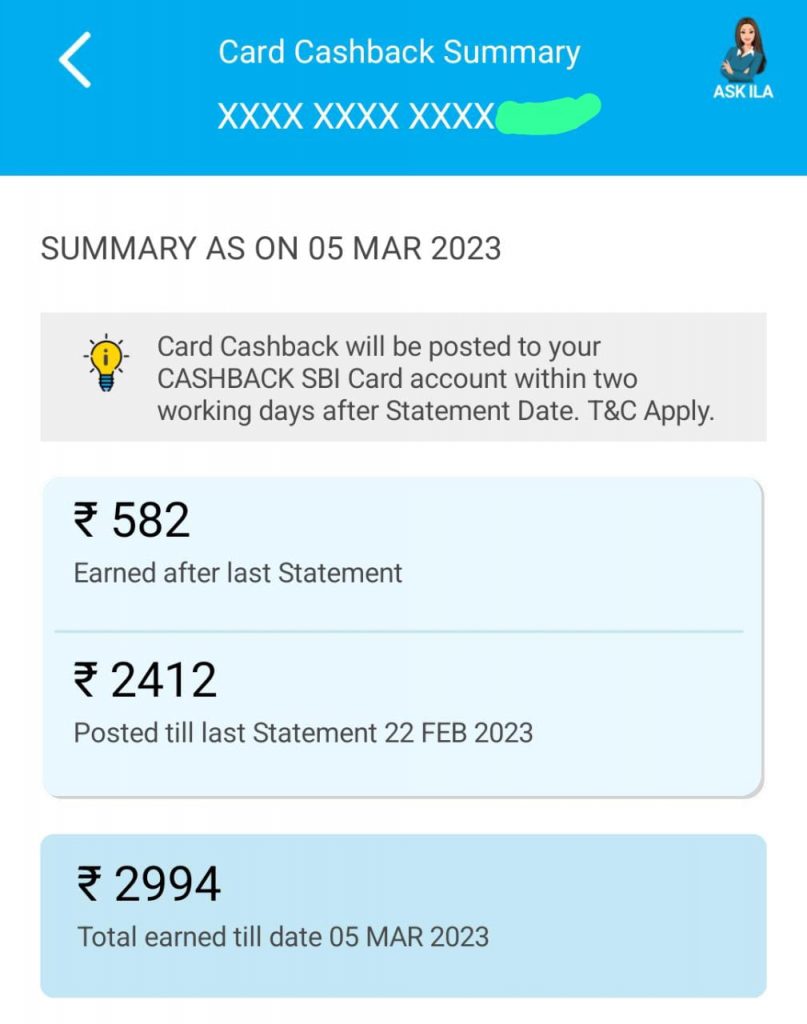

Cashback to be credited to statement within 2 days of statement generation (This is similar to Amazon Pay ICICI card where cashback is added to your Amazon pay account)

Lounge Benefit

- 1 complimentary lounge access / quarter (4 per year) (List of lounges)

My Take on this

The SBI Cashback Credit card with their 5% cashback feature is really a great feature. This basically beats a lot of other cashback credit cards like Amazon Pay ICICI card, Flipkart Axis etc considering the Merchant agnostic cashback benefit of 5%.

Also, the capping of Rs 10,000 is quite high. I do not think I have ever exceeded Rs 2 Lac online spends in a month, so this limit is pretty high for big spenders as well.

However, this 5% cashback is quite high and in times to come, there would be some more capping limits added to this cashback amount or some additional conditions added. So, if you are carrying other cashback cards without high annual fee or LTF, I would suggest to keep them and wait for an year or so and then take decision on removing the other cards. But for sure, the current features mean that this card is a must have.

Update – I had applied for this card in November 2022 and I have been using this card for online spends and getting 5% cashback on all online purchases. Total accumulation done – Rs 3K. This could have been higher but I am also using other cards and achieving their milestones first.

If you liked the features mentioned above and want to apply for this card or any other SBI Card, please apply through my referral link ( https://www.sbicard.com/invite/ja0hyfDJJ1e ). You will also get additional Rs 500 beyond the other card benefits.

Keep reading and please keep sharing…More Bachat on the way!!!